Image 1 of 1

Image 1 of 1

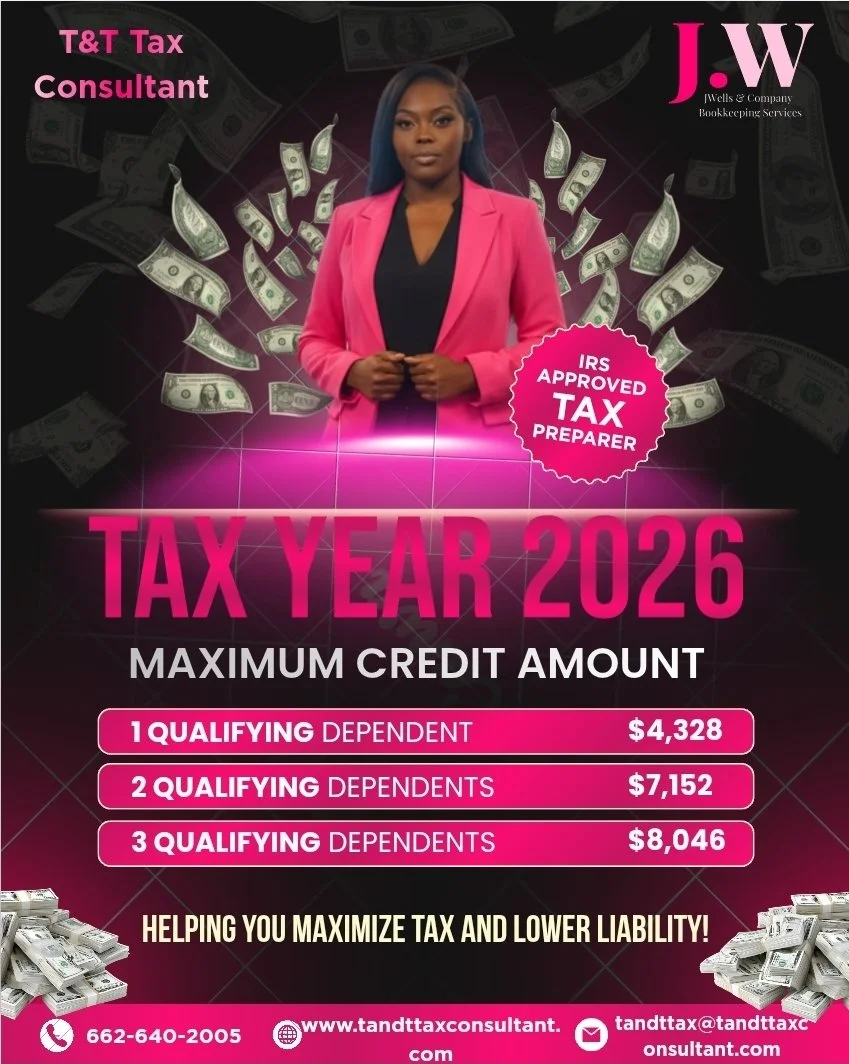

W2-With Dependents

Services for One W-2 With Dependents

Overview T&T Tax Consultant, LLC provides a focused, efficient tax preparation package for clients with a single W-2 income and one or more dependents. Our service ensures accurate filing, maximizes eligible credits and deductions, and reduces audit risk through professional review.

What we will do

Document review: Examine your W-2, Social Security numbers for you and dependents, prior-year return (if available), and supporting documents (childcare statements, education forms, healthcare coverage, etc.).

Filing status determination: Confirm the most advantageous filing status (single, head of household) based on dependents and living situation.

Dependency and exemption analysis: Verify dependent eligibility and ensure proper claim of qualifying child or qualifying relative rules.

Credits and deductions optimization:

Child Tax Credit and Additional Child Tax Credit

Child and Dependent Care Credit (review of provider information and expenses)

Earned Income Tax Credit (EITC) eligibility check and calculation

Education-related credits or deductions (American Opportunity Credit, Lifetime Learning Credit, if applicable)

Standard vs. itemized deduction evaluation (typically standard for single W‑2 with dependents; we’ll confirm)

Income reporting: Accurately report W-2 wages, retirement contributions, and taxable benefits if present.

Withholding review: Analyze your year-to-date withholding and provide guidance to adjust Form W-4 to avoid under- or over-withholding in future years.

State and local filings: Prepare applicable state (and local) tax returns and identify state-specific credits for dependents.

Direct deposit and e-file: Electronically file federal and state returns and set up direct deposit for refunds.

Audit support and representation: Provide limited audit support—explain notices, prepare responses, and coordinate with the IRS or state tax authorities. Full representation services available for an additional fee.

Services for One W-2 With Dependents

Overview T&T Tax Consultant, LLC provides a focused, efficient tax preparation package for clients with a single W-2 income and one or more dependents. Our service ensures accurate filing, maximizes eligible credits and deductions, and reduces audit risk through professional review.

What we will do

Document review: Examine your W-2, Social Security numbers for you and dependents, prior-year return (if available), and supporting documents (childcare statements, education forms, healthcare coverage, etc.).

Filing status determination: Confirm the most advantageous filing status (single, head of household) based on dependents and living situation.

Dependency and exemption analysis: Verify dependent eligibility and ensure proper claim of qualifying child or qualifying relative rules.

Credits and deductions optimization:

Child Tax Credit and Additional Child Tax Credit

Child and Dependent Care Credit (review of provider information and expenses)

Earned Income Tax Credit (EITC) eligibility check and calculation

Education-related credits or deductions (American Opportunity Credit, Lifetime Learning Credit, if applicable)

Standard vs. itemized deduction evaluation (typically standard for single W‑2 with dependents; we’ll confirm)

Income reporting: Accurately report W-2 wages, retirement contributions, and taxable benefits if present.

Withholding review: Analyze your year-to-date withholding and provide guidance to adjust Form W-4 to avoid under- or over-withholding in future years.

State and local filings: Prepare applicable state (and local) tax returns and identify state-specific credits for dependents.

Direct deposit and e-file: Electronically file federal and state returns and set up direct deposit for refunds.

Audit support and representation: Provide limited audit support—explain notices, prepare responses, and coordinate with the IRS or state tax authorities. Full representation services available for an additional fee.